Silver To Skyrocket in 2025: Understanding How To Invest in Silver

Silver is attracting renewed attention from investors in 2025, not just because of market volatility and geopolitical headlines amidst Trump’s tariffs and trade war, but due to strong supply and demand dynamics and compelling technical signals. In this article, we’ll explore what makes silver an interesting asset class, how economic fundamentals translate into price trends, how investors can analyse this market using technical analysis, and what kinds of instruments are available to invest in silver.

1. Supply and Demand: What Moves the Silver Market?

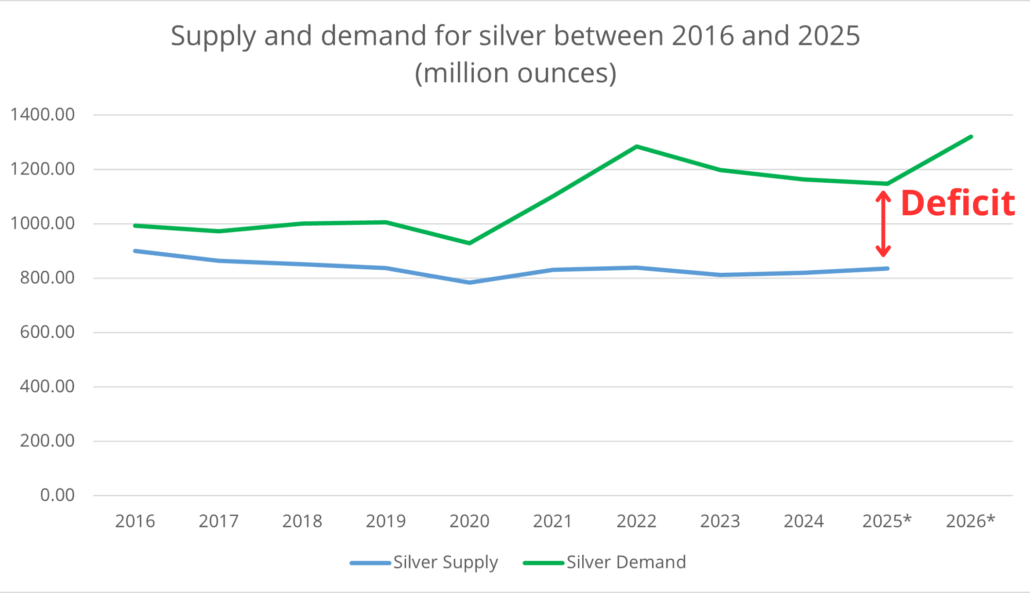

A key principle in investing is that prices are driven by the balance of supply and demand, and silver is a textbook example.

Annual demand for silver stands at approximately 1,020 million troy ounces, broken down as:

Electronics: ~300 million oz

Solar panels: ~190 million oz

Automotive, medical, chemical uses: ~86 million oz

Jewellery: ~180 million oz

Other uses (investment, silverware, photography): remainder

In contrast, supply, primarily from mining, is about 830 million ounces per year. This leaves a supply deficit of nearly 200 million ounces annually, a trend that is expected to widen over the coming years, according to analysts.

As is a fundamental economic principle that is covered in our various courses, such as our Investing for Beginners, when demand consistently outpaces supply, and in the case of precious metals mining cannot scale quickly, prices typically trend upward, especially when speculative and investment demand also rises.

We see that speculative demand for precious metals is on the rise due to their use by investors as a hedge on equity market exposures, due to the prevailing negative correlation between the two asset classes. This demand for gold and silver is driven by the uncertainty and volatility in equity markets due to Trump’s Trade War with China and his tariff policies with the rest of the world.

If you are interested in our analysis of the implications of the 2025 Trade War, what it means for investors, and how to hedge effectively, we recommend you also read our article: Understanding the 2025 Trade War and Hedging Strategies for Investors or watch our latest YouTube vlog on how to use commodities as a hedging strategy.

2. Forecasts for the Coming Years

According to data from various analysts and institutions, industrial demand is set to grow sharply in the next 1.5–2 years:

Solar energy demand for silver: +15%

Electric vehicle applications: +15%

Electronics: modest increase

Meanwhile, silver mining output is expected to grow by only 2–3% annually, further widening the imbalance.

This increasing industrial use, particularly from clean energy and mobility sectors, gives silver an underlying demand floor, which is often missing in purely speculative assets.

Source: The Silver Institute

3. Technical Analysis: Reading the Charts

As we explore in depth in our course Stocks for the Experienced Investor, while fundamentals tell us why a market may move, technical analysis helps us understand when and how far.

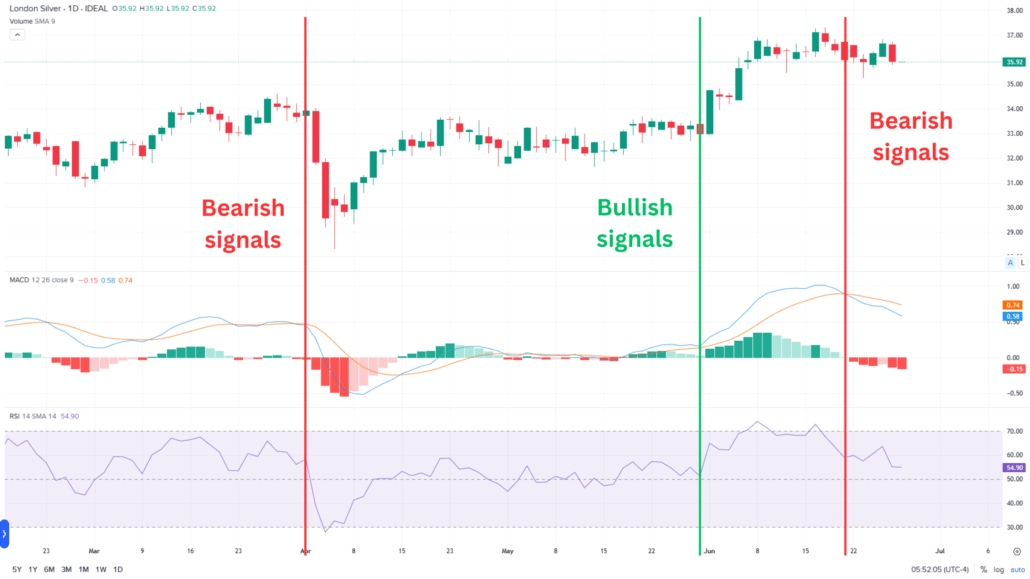

Silver is currently testing a major long-term resistance level near $36.36 per troy ounce.

The Relative Strength Index (RSI) is above 70, suggesting strong momentum, but also short-term overbought conditions (see the chart below).

The MACD (Moving Average Convergence Divergence) is beginning to flatten, hinting at potential consolidation (see the chart below).

When RSI exceeds 70 and the MACD begins to stall, it may signal that the market needs to cool off before continuing higher. However, in strong uptrends, momentum can remain elevated for extended periods.

Source: Interactive Brokers; own analysis

4. The Gold-Silver Ratio: Measuring Relative Value

The gold-silver ratio measures how many ounces of silver are required to buy one ounce of gold. As of 2025, it sits around 80, historically considered high.

Ancient norms: 10–20

20th-century average: 40–60

COVID-era peaks (2020): over 100

A high ratio implies silver is relatively cheap compared to gold. Many analysts see this as a potential catch-up opportunity for silver, especially since gold has already surged due to safe-haven inflows amid market uncertainty and Trump’s trade tariffs.

Ratios like gold-silver can help identify relative value opportunities, showing when one asset may be undervalued in comparison to another.

5. How to Invest in Silver

There are various different instruments available for investors to invest in silver:

a) ETCs (Exchange-Traded Commodities)

Ideal for long-term investors seeking direct exposure without leverage.

Traded easily like a share or ETF.

Physically backed and stored in secure vaults (e.g. HSBC)

Low annual cost (~0.49%)

Easy access via online investment platforms

b) Leveraged Products (e.g. XAG/USD)

More suitable for experienced traders familiar with Forex, ideally after taking our course Forex for Beginners and Experienced.

Forex-style instruments where silver can also be traded via forex pairs (e.g. XAG/USD)

Offering ~7% margin trading

Greater upside potential but higher risk

Subject to overnight financing charges

c) Physical Silver

Coins or bars for those wanting tangible assets.

No counterparty risk

Less liquid and involves storage/safety considerations

Each product type serves different investor profiles and risk tolerances. Understanding risk, leverage, and liquidity before you invest in silver or trade certain complex financial instruments, by educating oneself beforehand and taking our investing courses, is crucial.

6. Summary: Why Invest in Silver in 2025

Silver sits at the intersection of industrial utility, macroeconomic tension, and long-term scarcity. The setup in 2025 suggests a confluence of factors that could support higher prices:

Expanding green energy applications

Persistent supply deficits

Long-term undervaluation relative to gold

Technical indicators signaling a possible breakout

If you’re building a diversified commodities allocation, silver can be a compelling addition, especially for those seeking an asset tied to the real economy with long-term upside.

But, you invest in silver, certainly the best investment you can make is in your own understanding and education. At the Academy for Investors, we equip you with the tools to navigate markets with confidence, from mastering active stock picking and portfolio construction, to interpreting global trade and macroeconomic policy decisions.

Our courses in investing for beginners or the experienced are taught by finance experts with decades of experience are designed to turn uncertainty into opportunity, helping you make smarter, more resilient investment decisions when it matters most.

Knowledge is not just power—it’s protection.

-Teachers of the Academy for Investors

The information in this article should not be interpreted as individual investment advice. Although Hugo Broker Agencia de Valores, S.L. (¨Hugo Investing¨) compiles and maintains these pages from reliable sources, Hugo Investing cannot guarantee that the information is accurate, complete and up-to-date. Any information used from this article without prior verification or advice, is at your own risk. We advise that you only invest in products that fit your knowledge and experience and do not invest in financial instruments where you do not understand the risks.