Investing in Longevity and Anti-Ageing Stocks: A $38 Trillion Opportunity

At Academy for Investors, we regularly explore sectors, companies, and investment ideas that may shape the future. In this guide, we will walk you through one of the most exciting but still underappreciated themes in global markets: investing in longevity and anti-ageing stocks. This emerging area may represent a significant long-term opportunity for informed investors willing to understand the science, the economics, and the risks.

Before we go deeper, let’s briefly clarify a few foundational concepts:

- Longevity economy: the network of products, services, and companies focused on extending lifespan and improving healthspan (the years lived in good health).

- Healthspan: the portion of a person’s life spent in good physical and mental health, rather than simply being alive.

- UCITS ETF: a European-regulated exchange-traded fund that follows strict investor protection rules and is commonly used by European investors.

With these ideas in mind, we can start to examine where value might be created—and how investors can position themselves thoughtfully.

The Big Idea: Extending Human Life

Discussions about longevity are not new. For years, researchers, entrepreneurs, and high-profile innovators—including Elon Musk—have been fascinated by how technology and science could push human life expectancy far beyond today’s norms. Some forecasts even suggest that people in the current and coming generations could live to 120–150 years.

Longevity has three main drivers:

- Lifestyle: diet, exercise, sleep quality, and avoiding excess alcohol and smoking.

- Supplements & treatments: a global market estimated at hundreds of billions of dollars, aimed at supporting health, energy, and disease prevention.

- Advanced biotech & devices: from telomere-focused therapies and gene editing to brain–computer interfaces and other frontier technologies.

For investors, the key question is: where does the money flow, and which companies are best positioned to capture it? Understanding this is central to building a long-term, evidence-based strategy in longevity investing.

Supplements: A Fragmented Market

At first glance, supplement makers can look attractive. The industry is large and still growing, with global demand for vitamins, minerals, and anti-ageing products rising as populations age and consumers become more health-conscious.

Companies that have some exposure to longevity-related products include:

- Jamieson Wellness (JWEL:xtse)

- Usana (USNA:xnys)

- Herbalife (HLF:xnys)

- Church & Dwight (CHD:xnys)

However, once you look beneath the surface, several challenges appear:

- Many businesses are relatively small in scale, with limited global reach.

- Some, like Herbalife, have faced reputational risks related to their distribution models.

- Even larger consumer companies such as Nestlé (NESN:xvtx) only generate a small percentage of their revenue directly from longevity-specific products.

In short, supplements make up a massive industry, but it is fragmented and does not yet offer many clear, pure-play longevity stock opportunities for investors seeking focused exposure.

A Game-Changer? Metformin

Where our research becomes particularly interesting is in pharmaceuticals—specifically metformin, a decades-old diabetes drug that is now being investigated for its potential life-extending and healthspan-improving properties.

Metformin is thought to:

- Improve insulin sensitivity and reduce metabolic stress.

- Activate longevity-related enzymes such as AMPK, which influence energy balance and cellular ageing.

- Potentially reduce cancer proliferation and lower the risk of several age-related diseases, including heart disease, Alzheimer’s, and Parkinson’s.

- Offer a strong safety record, having been in use since the 1950s, and being off-patent—making it relatively cheap and scalable.

The economic implications of a genuinely effective longevity treatment are enormous. Even adding just one extra year of global life expectancy is estimated to unlock around $38 trillion in economic value. If ongoing and future clinical trials confirm metformin’s role in healthy ageing, demand could surge worldwide, with direct consequences for the companies that manufacture and distribute it.

Who Benefits? The Companies Behind It

Unlike the supplement space, here we find larger, more investable names with meaningful operations in metformin production and related pharmaceutical pipelines:

Merck KGaA (MRCG:xetr): A German pharmaceutical and chemical company that reports approximately €1 billion in annual revenues from metformin.

Teva Pharmaceuticals (TEVA:xnys): An Israeli company listed on NASDAQ with around $17 billion in annual turnover, a solid turnaround narrative, strong earnings growth expectations, and meaningful metformin production.

Sanofi (SAN:xpar): A French/Swiss global pharmaceutical heavyweight producing metformin, though without detailed breakdown of revenues by this specific product.

These companies are established pharmaceutical giants with the scale, balance sheets, and global distribution capacity to supply a large and growing market for longevity treatments, should regulatory approvals and clinical evidence support widespread use.

How Can Investors Invest in the Longevity Economy?

Beyond investing directly in companies that stand to benefit from longevity-related pharmaceuticals—such as Merck, Teva, and Sanofi—there are also firms that may gain indirectly from people living longer, healthier lives. This wider ecosystem is often referred to as the “longevity economy” and can include sectors such as financial services (e.g., banks and insurance companies), healthcare providers, and wellness technology firms.

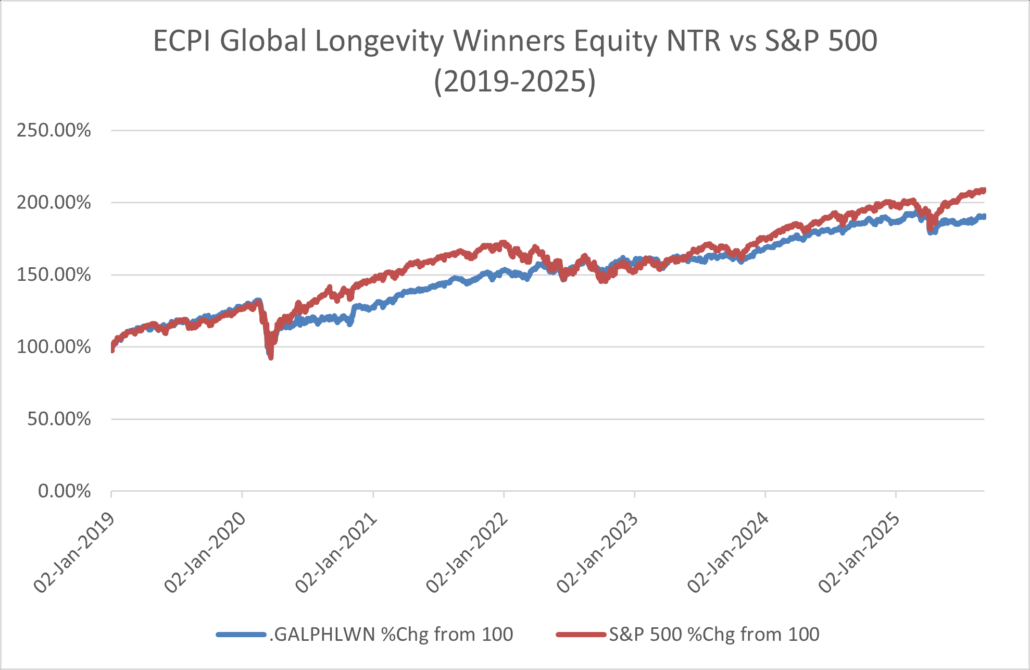

Source: LSEG/Refinitiv

Global markets are beginning to recognise the power of the longevity economy. To help investors track this trend, specialist equity indices have been created. As shown in the chart above, the ECPI Global Longevity Winners Equity NTR Index has delivered strong performance since 2019 and has moved broadly in line with the S&P 500. This suggests that longevity-focused companies are not just a niche concept, but an emerging area of mainstream institutional interest.

One way to gain exposure is through the CI Global Longevity Economy ETF (ticker: LONG), one of the few funds dedicated specifically to the longevity theme. However, liquidity remains low at the time of writing, which means that bid–ask spreads can be wide and trade execution less efficient. In addition, there is currently no UCITS-compliant longevity ETF available for European investors. Based on how other themes have developed, this is likely to change over time as demand from both retail and professional investors grows.

Until more suitable funds are launched, a practical approach is to study the constituents of these indices and ETFs. By doing so, investors can identify the individual companies that are actively shaping the longevity economy and consider taking direct positions in those stocks. This requires more research but gives you greater control over your exposure and risk.

If you enjoy exploring fast-growing sectors with disruptive potential, we recommend reading our guide on artificial intelligence investing: Decoding the AI Investment Landscape: Separating Bubble from Brilliance.

Investment Takeaways

As an investor studying the longevity sector, you can think in terms of three core strategies:

Ignore longevity as an investment theme for now, and wait until further scientific breakthroughs and regulatory approvals create more certainty.

Watchlist key pharmaceutical and biotech players—such as Merck, Teva, and Sanofi—and follow clinical trial results, regulatory news, and product pipelines closely.

Position early, accepting a higher level of risk today in exchange for the potential to benefit from significant upside if a longevity-approved therapy achieves mass adoption.

The Three Pillars of Longevity Investing

To approach longevity investing in a structured way, it can help to think in terms of three pillars:

- Demographic trends: ageing populations in developed markets and rising healthcare spending.

- Regulatory milestones: approvals, labelling changes, and new clinical guidelines that can unlock demand.

- Innovation pipelines: the strength of a company’s research and development in drugs, diagnostics, and health technologies linked to lifespan and healthspan.

By assessing each of these pillars, you move from speculation toward a more systematic, education-based investment process—exactly the mindset we encourage at Academy for Investors.

The market has already seen how quickly demand can escalate when a new health paradigm goes mainstream. Weight-loss drugs like Ozempic and similar treatments became a multi-billion-dollar category in a very short period of time. If metformin—or another scientifically validated treatment—secures formal longevity approval, investors who have positioned themselves thoughtfully ahead of that shift could benefit substantially.

Final Word on Investing in Longevity Stocks

Longevity investing may feel like unfamiliar territory. Many listed companies in this area are small-cap, some lack pure-play exposure to longevity, and reputational risks can still exist. Yet throughout investing history, breakthrough narratives often begin with scepticism before becoming mainstream. A well-known medication repurposed for longevity could become one of the most significant economic themes of the 21st century—reaching across pharmaceuticals, insurance, healthcare services, and consumer wellness.

For now, it can make sense to keep your analytical focus on larger, better-known names such as Merck, Teva, and Sanofi. Longevity science may not only extend human life; it may also extend the growth potential of a diversified investment portfolio.

As long-term investors, we must recognise the demographic shifts shaping the global economy. Developed countries face falling birth rates, ageing populations, and rising healthcare spending. At the same time, developing nations continue to expand their consumer base. These forces are creating new markets, new needs, and new opportunities. If this topic interests you, you may also enjoy our analysis of another growth engine: Investing In Indian Stocks: The Next Big Opportunity?

If you are still building your foundation in topics such as position sizing, diversification, and downside protection, we also encourage you to explore our educational resources and courses at Academy for Investors. A strong understanding of risk management is essential when dealing with emerging themes like longevity.

If you’re unsure how to structure an investment strategy around longevity stocks—or how to trade companies such as Merck, Teva, or Sanofi on our trading platforms—our team can guide you.

In emerging themes like these, a well-built strategy is not optional; it is essential. Feel free to contact us for support.

Our courses in investing for beginners or the experienced are taught by finance experts with decades of experience are designed to turn uncertainty into opportunity, helping you make smarter, more resilient investment decisions when it matters most.

Knowledge is not just power—it’s protection.

-Teachers of the Academy for Investors

The information in this article should not be interpreted as individual investment advice. Although Hugo Broker Agencia de Valores, S.L. (¨Hugo Investing¨) compiles and maintains these pages from reliable sources, Hugo Investing cannot guarantee that the information is accurate, complete and up-to-date. Any information used from this article without prior verification or advice, is at your own risk. We advise that you only invest in products that fit your knowledge and experience and do not invest in financial instruments where you do not understand the risks.